Payroll Financing

For businesses that are facing cash flow constraints, ABHI offers the facility of Payroll Financing to bridge the gap between inflows and outflows, enabling them to pay their employees’ salary on time and have greater control over their finances.

How It Works

Step-by-step process of the user’s journey

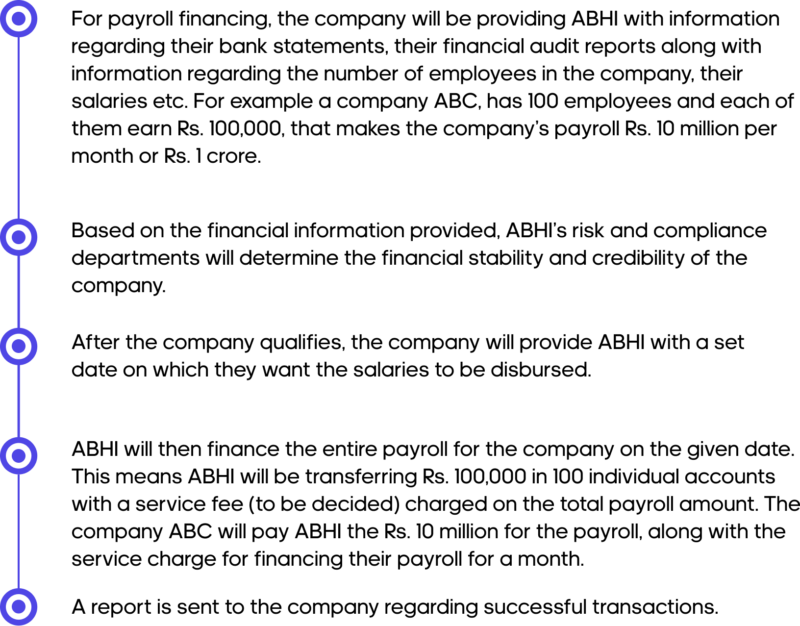

- For payroll financing, the company will be providing ABHI with information regarding their bank statements, their financial audit reports along with information regarding the number of employees in the company, their salaries etc. For example a company called ABC has 100 employees and each of them earn Rs. 100,000, that makes the company’s payroll Rs. 10 million per month or Rs. 1 crore.

- Based on the financial information provided, ABHI’s risk and compliance departments will determine the financial stability and credibility of the company.

- After the company is successfully onboarded, they will provide ABHI with a set date on which they want the salaries to be disbursed.

- ABHI will then finance the entire payroll for the company on the given date. This means ABHI will be transferring Rs. 100,000 in 100 individual accounts with a service fee (to be decided) charged on the total payroll amount. The company ABC will pay ABHI the Rs. 10 million for the payroll, along with the service charge for financing their payroll for a month.

- A report is sent to the company regarding successful transactions.

Use Cases

When and where can this be used?